Introduction

In the dynamic landscape of global commerce, Trade Legal Due Diligence in China has emerged as a critical component for foreign investors seeking to navigate this complex market. Understanding the nuances of this process is essential, as it not only informs investment decisions but also safeguards against potential pitfalls. Without a solid grasp of Trade Legal Due Diligence in China, investors may find themselves facing unexpected challenges that could jeopardize their ventures.

Understanding Trade Legal Due Diligence in China

Trade Legal Due Diligence in China involves a comprehensive examination of legal and regulatory frameworks that govern business operations within the country. This process encompasses everything from compliance with local laws to assessing the credibility of potential partners and suppliers. By thoroughly understanding these elements, investors can better position themselves for success while minimizing risks associated with foreign investments.

Importance of Diligence for Foreign Investment

The importance of diligence cannot be overstated when it comes to foreign investment in China; it serves as both a shield and a sword. A robust due diligence process not only identifies potential red flags but also highlights opportunities that might otherwise go unnoticed. In an environment where regulatory changes are frequent, maintaining diligence ensures that investors remain compliant and competitive.

Key Challenges for Foreign Investors

Foreign investors face several key challenges when engaging in Trade Legal Due Diligence in China, including navigating complex regulations and cultural differences. The lack of transparency can create significant hurdles, making it difficult to obtain accurate information about potential investments or partners. Additionally, language barriers often complicate communication and further obscure understanding—underscoring the necessity for meticulous due diligence practices.

The Fundamentals of Trade Legal Due Diligence

Understanding the fundamentals of Trade Legal Due Diligence in China is crucial for any foreign investor looking to navigate this complex market. This process entails a thorough examination of legal, financial, and operational aspects before entering into a business venture. By grasping the definition and scope, investors can better prepare themselves for the unique challenges that lie ahead.

Definition and Scope

Trade Legal Due Diligence in China refers to the comprehensive assessment of legal risks associated with potential investments or business operations within the country. This includes evaluating contracts, compliance with local laws, and understanding regulatory frameworks that may impact business decisions. The scope often extends beyond mere legalities; it encompasses cultural nuances and market conditions that could affect an investment's success.

Importance in Investment Strategy

Incorporating Trade Legal Due Diligence in China into an investment strategy is not just advisable; it's essential for mitigating risks and maximizing returns. Investors who conduct thorough due diligence can identify potential pitfalls early on, allowing them to make informed decisions that align with their business objectives. Furthermore, this diligence fosters confidence among stakeholders by demonstrating a commitment to compliance and ethical practices.

Major Players in the Chinese Market

The landscape of Trade Legal Due Diligence in China is populated by various key players who shape its dynamics—government agencies, local partners, law firms, and industry regulators all play significant roles. Understanding these players helps foreign investors navigate regulations effectively while building vital relationships that can facilitate smoother market entry. Moreover, collaboration with local experts enhances due diligence efforts by providing insights into regional practices and expectations.

Navigating China’s Regulatory Landscape

When venturing into the vast market of China, understanding the regulatory landscape is crucial for effective Trade Legal Due Diligence in China. The legal environment can be complex and multifaceted, influenced by a myriad of laws and regulations that govern foreign investments. Therefore, familiarizing oneself with these frameworks is essential for mitigating risks and ensuring compliance.

Overview of Applicable Laws

The legal framework governing foreign investment in China includes a variety of laws, such as the Foreign Investment Law, Company Law, and various sector-specific regulations. These laws outline the rights and obligations of foreign investors while also establishing guidelines for market entry and operational conduct. Additionally, recent reforms aim to simplify procedures but also require a keen understanding of how Trade Legal Due Diligence in China applies to different sectors.

Foreign investors must navigate not only national laws but also local regulations that may vary significantly across provinces and municipalities. This decentralized approach means that local governments have substantial authority to impose additional requirements or incentives for foreign entities operating within their jurisdictions. Thus, thorough due diligence is imperative to identify which laws apply specifically to your business model.

The Role of the Ministry of Commerce

The Ministry of Commerce (MOFCOM) plays a pivotal role in shaping policies related to foreign investment in China. As a primary regulatory body, MOFCOM oversees the approval process for foreign investments and ensures compliance with national economic strategies. Understanding MOFCOM's functions can significantly enhance your Trade Legal Due Diligence in China by providing clarity on what is required at each stage of investment.

One key responsibility of MOFCOM is managing the Foreign Investment Negative List, which outlines sectors where foreign investment is restricted or prohibited. This list serves as both a guide and a warning; failing to heed its stipulations can lead to penalties or denial of investment applications. Thus, keeping abreast of any changes issued by MOFCOM should be an ongoing part of your due diligence strategy.

Additionally, MOFCOM facilitates communication between foreign investors and Chinese authorities, making it easier for companies to navigate bureaucratic hurdles. Engaging with this ministry early on can provide invaluable insights into current trends and expectations within China's regulatory framework—an essential component when conducting Trade Legal Due Diligence in China.

Compliance Requirements for Foreign Entities

Compliance requirements for foreign entities are extensive and often evolving as China's economy continues to grow dynamically. Key areas include tax obligations, environmental regulations, labor laws, intellectual property rights protection, and data privacy requirements—all critical components that must be addressed during due diligence efforts. Understanding these compliance mandates helps mitigate potential liabilities associated with non-compliance.

Moreover, companies must establish internal mechanisms that ensure adherence to both local laws and international standards—failure to do so could result in hefty fines or damage to reputation over time. Regular audits are advisable as part of ongoing Trade Legal Due Diligence in China; they help identify gaps between actual practices versus regulatory expectations before issues arise.

Finally, it's important not just to comply but also actively engage with stakeholders such as local governments or industry associations who can provide guidance on best practices regarding compliance requirements specific to your industry sector. Building these relationships will further enhance your due diligence process while positioning your business favorably within China's competitive landscape.

Identifying Risks and Liabilities

Navigating the landscape of foreign investment in China is like walking a tightrope—one misstep can lead to significant consequences. Trade Legal Due Diligence in China is vital for identifying potential risks and liabilities that could derail an investment strategy. Understanding these risks is essential for foreign investors who want to safeguard their interests while capitalizing on the opportunities presented by one of the world's largest markets.

Common Risks in Foreign Investment

Foreign investors face a myriad of risks when entering the Chinese market, ranging from regulatory hurdles to cultural misunderstandings. One common risk is the unpredictability of local regulations, which can change rapidly and without warning, potentially affecting business operations overnight. Additionally, there are market entry risks, such as competition from domestic companies that may have deeper insights into consumer behavior and preferences.

Another prominent risk involves intellectual property (IP) protection; despite improvements in legislation, enforcement remains inconsistent, leaving foreign businesses vulnerable to IP theft or infringement. Furthermore, currency fluctuations pose a financial risk that can impact profitability and investment returns. Therefore, conducting thorough Trade Legal Due Diligence in China helps identify these potential pitfalls before they become costly mistakes.

Legal Liabilities and Penalties

Legal liabilities can be daunting for foreign investors who fail to comply with China's complex legal framework. Violations of trade regulations or failure to adhere to compliance requirements can result in hefty fines or even bans on doing business within the country. This underscores the importance of understanding not just local laws but also international treaties that may affect operations.

Moreover, breaches related to labor laws or environmental regulations can lead not only to financial penalties but also reputational damage that could hinder future endeavors in Asia's lucrative markets. Investors must be aware that legal challenges may arise from both government actions and private disputes with local businesses or consumers. Therefore, rigorous Trade Legal Due Diligence in China becomes imperative for avoiding such liabilities.

Strategies for Risk Mitigation

To navigate these choppy waters successfully, foreign investors should develop comprehensive strategies aimed at mitigating identified risks and liabilities effectively. First and foremost, engaging local legal experts familiar with China's regulatory environment is essential; they provide invaluable insights into compliance requirements while helping avoid common pitfalls associated with trade practices.

Additionally, implementing robust internal controls ensures adherence to local laws while fostering a culture of compliance within the organization itself—after all, prevention is better than cure! Regular audits and assessments should be part of this strategy; they help identify new risks as they emerge while allowing companies to adapt proactively rather than reactively.

Lastly, establishing strong partnerships with local firms enables foreign entities not only access to valuable networks but also enhances their understanding of market dynamics—a critical component when navigating Trade Legal Due Diligence in China successfully.

The Process of Conducting Due Diligence

Conducting Trade Legal Due Diligence in China is a meticulous process that ensures foreign investors can navigate the complexities of the Chinese market with confidence. The steps involved are designed to uncover potential risks, legal liabilities, and compliance issues that could impact investment success. By following a structured approach, investors can make informed decisions and lay a solid foundation for their ventures.

Steps Involved in Due Diligence

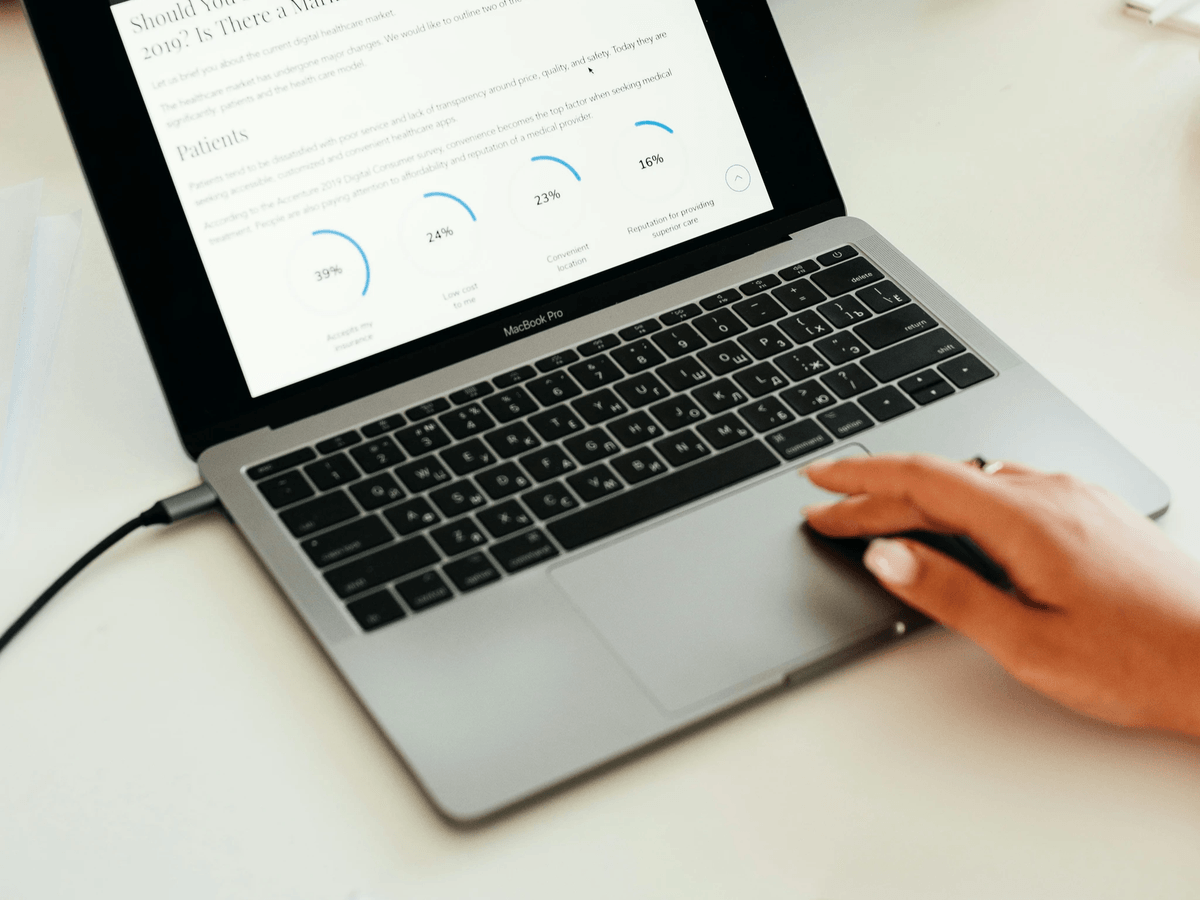

The first step in conducting Trade Legal Due Diligence in China is to define the scope of the investigation based on specific investment goals. This typically involves identifying key areas such as regulatory compliance, financial health, and operational practices of the target company or industry. Once the scope is established, investors should gather relevant information through various means such as interviews, document reviews, and site visits to ensure a comprehensive understanding of the business landscape.

Next comes analysis—sifting through collected data to identify any red flags or discrepancies that might indicate potential risks. Investors need to pay close attention to local laws and regulations that could affect their operations or lead to unforeseen liabilities. Finally, compiling findings into a detailed report will provide clarity on whether proceeding with an investment is advisable based on identified risks.

Essential Documentation and Verification

In Trade Legal Due Diligence in China, having access to essential documentation is crucial for verifying claims made by potential partners or acquisitions. Key documents include business licenses, tax records, financial statements, contracts with suppliers and customers, and any litigation history relevant to the company’s operations. Each piece of documentation serves as a puzzle piece that helps investors build an accurate picture of the business's legal standing.

Verification processes are equally important; they involve cross-referencing information from different sources to confirm its accuracy and authenticity. This may include checking government databases for licensing status or consulting third-party audits for financial reliability. Thorough verification not only mitigates risk but also strengthens investor confidence when making decisions about entering the Chinese market.

Engaging with Local Experts

Engaging local experts is often an indispensable part of conducting Trade Legal Due Diligence in China effectively. These professionals possess invaluable insights into regional laws, cultural nuances, and business practices that foreign investors may overlook or misinterpret without adequate experience in the market. Utilizing their knowledge can help bridge gaps between foreign expectations and local realities.

Local experts can assist in navigating complex regulatory frameworks while also providing guidance on compliance strategies tailored specifically for foreign entities operating within China’s unique environment. Additionally, they can facilitate introductions to key stakeholders or governmental bodies which are essential for establishing strong partnerships necessary for success in this competitive landscape. Ultimately, leveraging local expertise enhances due diligence efforts significantly while minimizing risks associated with unfamiliarity.

Case Studies: Successes and Failures

When it comes to Trade Legal Due Diligence in China, real-life examples can be both enlightening and cautionary tales. Companies that have successfully navigated the complex landscape of foreign investment often highlight the critical role of thorough due diligence in their triumphs. Conversely, those that have stumbled frequently cite insufficient legal groundwork as a key factor in their setbacks.

Analyzing Real-Life Examples

One notable success story is that of a European automotive manufacturer that entered the Chinese market with a well-structured Trade Legal Due Diligence strategy. By engaging local legal experts and conducting comprehensive market analysis, they identified potential regulatory hurdles early on, allowing them to adapt their business model accordingly. In contrast, an American tech firm faced significant challenges after neglecting due diligence; they were blindsided by stringent data protection laws which resulted in hefty fines and operational delays.

These contrasting cases underscore the importance of understanding local regulations and compliance requirements through robust Trade Legal Due Diligence in China. Companies must recognize that what works in one jurisdiction may not be applicable in another, especially within China's unique regulatory framework. The lessons learned from these examples highlight how due diligence can make or break an investment venture.

Lessons Learned from Market Entry

The primary lesson emerging from these case studies is that meticulous preparation pays off—literally. Successful companies often emphasize the need for a comprehensive understanding of local laws, cultural nuances, and market dynamics before committing resources to China. This approach not only mitigates risks but also enhances relationships with local stakeholders who appreciate foreign entities taking the time to understand their environment.

On the flip side, firms that rushed into investments without adequate Trade Legal Due Diligence in China often found themselves mired in legal disputes or facing unexpected compliance challenges. These experiences serve as stark reminders of why due diligence should never be viewed as a mere checkbox exercise but rather as an integral part of any investment strategy. The insights gained from analyzing successes and failures can guide future investors toward making informed decisions.

The Role of AC&E in Successful Ventures

In many successful ventures within China’s complex landscape, organizations like AC&E (Advisory Consulting & Expertise) have played a pivotal role by providing tailored guidance on Trade Legal Due Diligence in China. Their expertise helps foreign investors navigate regulatory frameworks while ensuring compliance with local laws—essentially acting as a bridge between cultures and business practices. By leveraging AC&E's knowledge base, companies can significantly reduce risks associated with entering this dynamic market.

Additionally, AC&E's involvement often leads to stronger partnerships between foreign firms and Chinese businesses by fostering trust through transparency and adherence to legal standards. This collaborative approach not only enhances operational efficiency but also cultivates goodwill among local stakeholders—a crucial element for long-term success in any foreign market entry strategy focused on Trade Legal Due Diligence in China.

Conclusion

In the intricate world of foreign investment, mastering Trade Legal Due Diligence in China is not just a checkbox on a to-do list; it’s a vital component for success. Thorough due diligence enables investors to navigate the complexities of the Chinese market while minimizing risks and maximizing opportunities. Investors who prioritize this process are more likely to build sustainable operations and foster long-term growth in one of the world's most dynamic economies.

Mastering Due Diligence for Investment Success

Successfully navigating Trade Legal Due Diligence in China requires an understanding that goes beyond mere compliance; it demands strategic insight into local customs and business practices. Investors must be proactive, conducting comprehensive assessments that encompass not just legal frameworks but also cultural nuances that could impact their operations. By developing an effective due diligence strategy, foreign investors can identify potential pitfalls before they become costly mistakes.

The Ongoing Importance of Compliance

Compliance isn't a one-time effort; it's an ongoing commitment that can make or break your investment in China. The landscape of laws and regulations is ever-evolving, making it essential for investors to stay informed about changes that could affect their operations. Regular audits and updates to compliance strategies ensure that companies remain aligned with local laws while safeguarding their investments against unforeseen liabilities.

Building Strong Partnerships in China

Strong partnerships are the lifeblood of successful ventures in the Chinese market, where relationships often dictate business outcomes more than contracts do. Engaging with local experts who understand Trade Legal Due Diligence in China can provide invaluable insights and facilitate smoother navigation through regulatory hurdles. By fostering trust and collaboration with local stakeholders, foreign investors can create a solid foundation for long-term success.